In a mobile-centric world, app usage is at an all-time high. In comparison, inflation squeezes the spending in games app services, see headwinds.

Different verticals of apps continue to hypercharge with consumers’ Time and transactions. Be it gaming, retail, food/ride services, finance, fintech, and edutech, it insists brands proactively subsidize in designing potent app-based understandings and capacities, making the most of the surge in user engagement and Time.

Approximately mobile-first markets spend 5 hours each day on mobile:

After analyzing the top 10 markets, it has been observed that 9% up, i.e. 5 hours 2 minutes, is seen from 2020 to 2022- during COVID.

Indonesia, Brazil, Saudi Arabia, Singapore, and South Korean users have crossed the 5 hours per day spent in mobile apps in 2022.

Time spent grew by 68%, 67%, and 62% over the four years in Saudi Arabia, Australia, and Singapore.

Downloads and Time Spent are indirectly proportional to Consumer Spend.

Globally, in 2022, a drop in consumer spending is seen by -2%. The market of Tawain, Brazil, Hong Kong, and Mexico topped the trend at 15%, 22%, 34% and 17%, respectively.

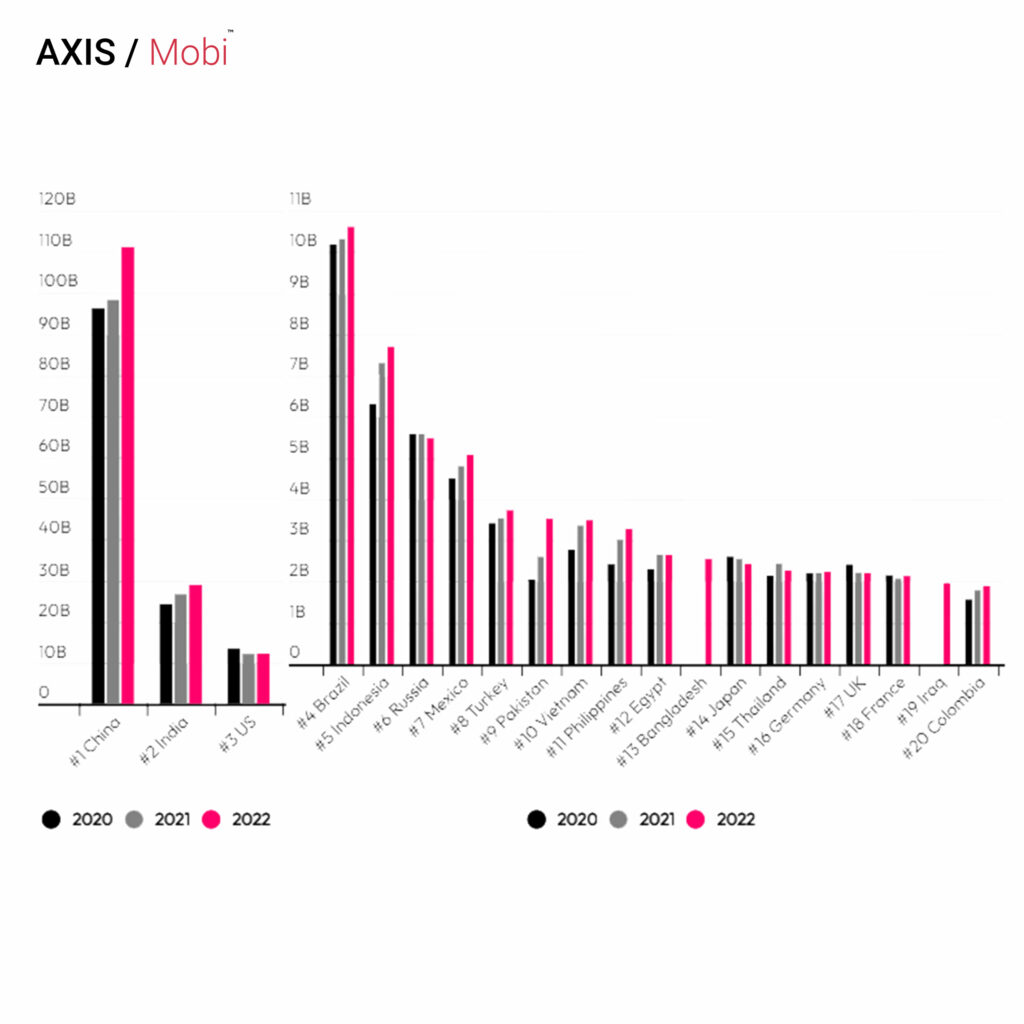

The download grew at 11% YoY. Pakistan, being the 10th largest market, saw growth at 35%.

Due to an increase in consumers in Pakistan (20%), Russia (20%), and Ukraine (45%), the Time spent grew by 9% YoY. The main reason behind the massive increase in Ukraine is the war, as the consumers relied more on communication and connection.

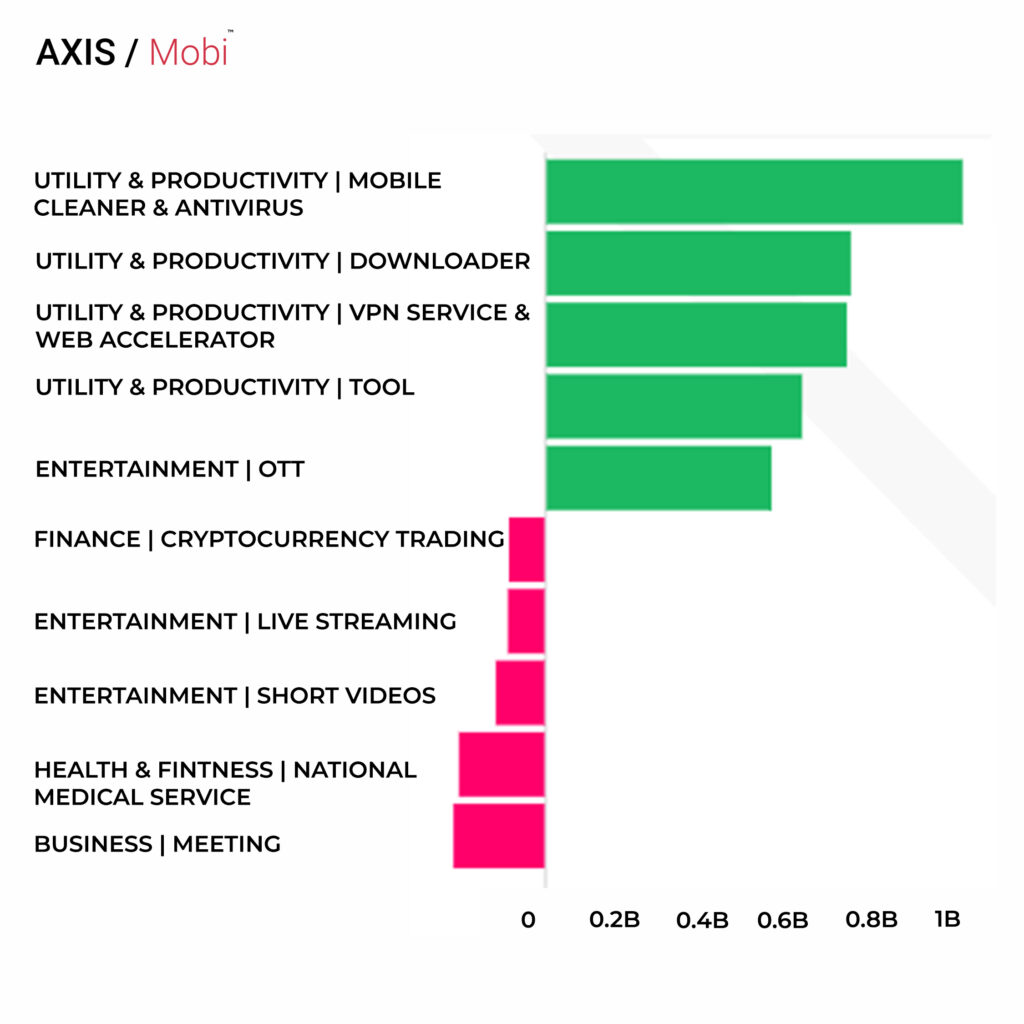

Three categories had a total Monopoly on the Time spent.

Around six categories accounted for 50% of the hold on consumer spending and 20% on downloads.

OTT Apps stood #1 on the downloads and consumer spending list 2022. In that, spent 16% of dollars on in-app subscriptions and purchases and 4% on downloads. In contrast, mobile web browsers accounted for 8% of the Time spent. Undoubtedly, the web is still crucial for marketing and the user acquisition funnel; the app gets more attention and meaningful engagements concerning the former.

With consumer disposable income squeeze, the spending on games declined, and apps remained resilient.

The biggest hits in 2022 were on gaming apps. ‘Need-to-more’ services proved stronger and mirrored consumer behaviour similar to how people treat cable bills.

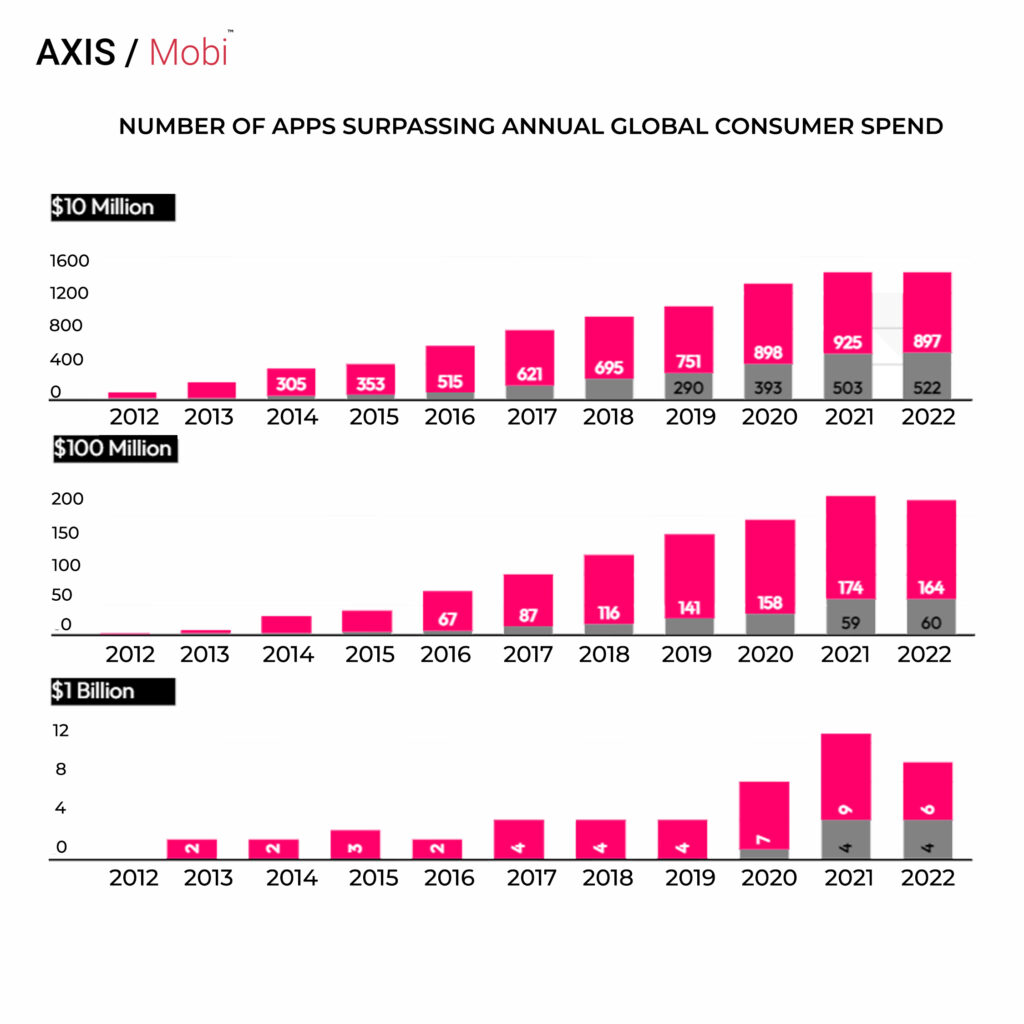

A 1$ Billion Club of 2022

Over the previous year, around 1400 apps and games generated more than $10 Million. Among that, 224 surpassed $100 million, and 10 reached $1 billion annually.

Decline spending impacted games disproportionately. As consumer spending cooled, 60% of the apps that represent gaming were also severely affected. The games crossing around $10M, $100M and $1B dropped by -1%, -4% and -33% YoY, respectively.

Source: Data.ai